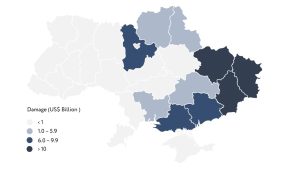

The Ukrainian economy suffered significant losses due to the Russian invasion. As of February 2023, the total amount of damages to the infrastructure of Ukraine amounted to $143.8 billion (KSE, 2023). In this war, infrastructure is the second most hit area by the number of damages, over 25,000 kilometers of state and local roads and 344 bridges and overpasses were destroyed or damaged (KSE, 2023). The damages to telecom & digital infrastructure amount to $1.6 billion, water & sanitation to $2.2 billion, municipal services to $2.4 billion, and energy and extractive infrastructure – $10.6 billion (WB Group, 2023).

Generally, large-scale investments in infrastructure can act as growth catalysts for post-crisis countries. During the war, the government invested in the infrastructure of the western border areas to increase the export capacity of the country, supporting its vision of becoming a reliable transcontinental transit partner for neighboring countries and a business partner of the European Union. Moreover, after the full-scale invasion, the government opened up infrastructure for private investment, which earlier was mainly a state-owned industry.

So far, the key partners supporting Ukraine’s recovery have been states and international organizations. For instance, the World Bank provided $100 million for the so-called infrastructure survival projects, aimed at restoring transport connections between cities and expanding export logistics potential within a short period of 6–9 months. The European Bank for Reconstruction and Development invested €1.7 billion in Ukraine, allocated to support the real sector of Ukraine’s economy, including investments in vital infrastructure, energy and food security, trade, and private sector support. The United Nations World Food Program supports Ukraine’s Grain Deal and agricultural land demining projects. A number of countries including the Czech Republic, France, and Norway provided Ukraine with over 80 temporary bridges and river crossings as humanitarian assistance. Moreover, last year, President Zelenskyy proposed a new model of recovery to international partners: the patronage of a particular region, city, community, or industry, which attracted the interest of 30 countries.

rebuilding Ukraine’s infrastructure

A map of Ukraine’s post-war reconstruction under the patronage system. Source Slovo i Dilo

Regarding investment opportunities, the Ukrainian government has reported over 30 infrastructure and logistics investment projects with an investment potential of $123 billion on the Advantage Ukraine platform. Moreover, at the Ukraine Recovery Conference in Lugano in July 2022, Ukraine’s Prime Minister presented the Ukraine Recovery Plan, open to private investment, with a total of 850 projects to complete over the next 10 years. Some of the infrastructure investment projects include the construction of buildings with zero greenhouse gas emissions, the construction of a new cargo terminal at Boryspil International Airport SoE, the electrification of rail tracks, the development of the road and rail infrastructure of Izmail Seaport, the system of green energy charging stations, restoration of Solotvyno salt mines, development of biofuel production from agricultural products & waste, and the localization of window and glass production. Today, the key priority for investment is energy and critical infrastructure, as it will allow Ukrainians to return home and stabilize life in their communities, according to the Ministry of Economy.

Despite the full-scale war, some private investments proved to be very successful, one of the most striking examples is the container terminal in the port of Reni. This project was launched with Swedish investments, and the main partner is the international transportation company Maersk. It increased the number of transshipped containers from 2 in 2019 to 14,000 in the five months of 2022-2023. Moreover, in the summer of 2022, Ukraine and the United Kingdom signed a Memorandum on Infrastructure Rebuilding in Ukraine. The Memorandum opens the way for British businesses to participate fully in the reconstruction of our country’s infrastructure destroyed by Russia. In particular, it provides for a pilot project to build 6 bridges in the Kyiv region. It involves British companies and funding from UK Export Finance. The last example is Risoli’s infrastructure project of the two-sided pier in the port of Chornomorsk, its construction started in 2021 but was finished amid the full-scale war. Now it is being prepared to be put into operation.

Investing in Ukraine’s infrastructure is not without challenges. The ongoing war, corruption, imperfect rule of law, and unpredictability of state actions can pose significant risks for investors. The country is working on approximating its legal system and regulatory environment to the one of the European Union to lessen the uncertainties for investors.

The need for private investment is striking, as the amount of available grant funds is less than Ukraine’s needs for recovery. At the same time, even during the war, Ukraine’s infrastructure rebuilding efforts present significant opportunities for investors. Currently, the government provides incentives and war insurance guarantees to private investors, which will not be the case after the war.

Overall, investing in Ukraine’s infrastructure can be a rewarding opportunity for those willing to navigate the challenges and take reasonable risks associated with the current situation in the country. CFC Big Ideas is ready to provide our expertise and support to investors looking to participate in the rebuilding process. Please, book a call with us if you are interested, using the form below.

****

The material was prepared by Nina Kurochka, Account Executive at CFC Big Ideas.